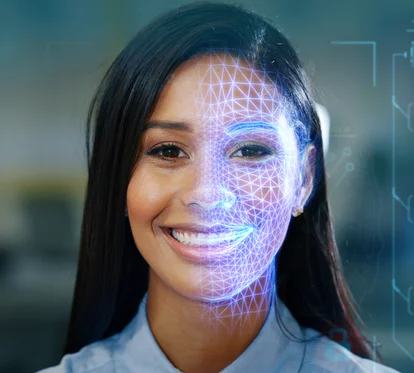

The checkout process as we know it is about to undergo a revolution that will completely transform the way we pay. Say goodbye to clunky old card payments, and say hello to a future where the payment experience is seamless, frictionless, and oh-so-convenient. With cutting-edge technologies like biometrics, wearables, and facial recognition leading the charge, we are entering a whole new era of retail payments. The possibilities are practically endless. Imagine paying for your morning coffee with just a smile or completing a purchase by simply scanning your iris. And that's just the beginning — emerging technologies are also paving the way for the use of alternative assets like cryptocurrencies and loyalty credits.

Pay with a smile: the future of checkout

To provide customers with a more seamless and convenient payment experience, retailers are increasingly embracing innovative payment methods.

But as with any other groundbreaking change, there are also important privacy and ethical issues that need to be addressed. We must ensure that customer data is protected at all times and make transparency a top priority. Seamless payment technologies could play a crucial role in this regard as well, as they can help prevent fraud and theft. So, join us as we take a deep dive into the evolution of the checkout process and explore the potential benefits and challenges of these exciting new payment technologies. We'll also take a closer look at the importance of ethical implementation, examine the role of privacy and security in this rapidly changing landscape, and discuss how to create a more efficient and secure payment experience that not only enhances the checkout process, but also respects the values of customers as well as retailers.

Secure and convenient transactions with wearables and biometrics

Wouldn’t it be great if you didn’t have to fumble through your pockets for your wallet or frantically search your bag for your phone every time you need to pay for something? No swiping, dipping, or tapping required. Sound like a dream? Well, guess what? It's not. Thanks to the magic of biometrics, this is now becoming our reality. Never again will you have to go through the tedious process of validating your payment with a PIN or signature — with biometrics, you are the key to your own security. Your unique physical characteristics like your fingerprint or facial features are all the validation you need to make a purchase. No more struggling to remember yet another PIN or worrying about someone else accessing your account. For example, Mastercard recently rolled out a new feature that allows customers to pay for their store purchases by simply flashing a smile. To make use of the feature, customers need to sign up on the PayFace app, scan their face, and enter their payment information. Then, the next time they’re at the checkout, they can just smile and walk out. “The way we pay needs to keep pace with the way we live, work and do business, offering choice to consumers with the highest levels of security”, says Ajay Bhalla, President of Cyber and Intelligence at Mastercard. “Our goal with this new programme is to make shopping a great experience for consumers and merchants alike, providing the best of both security and convenience”.

The Polish computer retail chain Komputronik has taken a slightly different approach. They’ve installed an iris recognition solution developed by PayEye in one of its stores in Wrocław, southwest Poland, which will enable customers to pay for their purchases by scanning their eye. Besides biometrics, wearables are also increasingly used to provide alternative payment methods. The wearable technology startup Flywallet recently partnered with Fingerprints, one of the world’s leading biometrics companies, to develop a new range of biometric wearable products. The partnership will enable Flywallet to provide its wearables with an additional layer of security by equipping them with biometric sensors. This will expand possible use cases for the technology to areas like payments, ticketing, and loyalty services. A similar service will soon be available to customers in the Netherlands, where the sustainable fashion brand AdornPay, which produces watch straps, key rings, key fobs, and bracelets made from recycled silver and gold, partnered with the UK-based fintech company Digiseq to launch ethically produced wearable items that enable customers to pay for their purchases quickly and securely.

The future of payments

The way we pay for things has changed dramatically over the years. Long gone are the days of waiting in line at the store or counting out exact change. Today, we can pay for pretty much anything with just a few taps on our phones. And we don’t even have to leave our homes to do it. As technology continues to develop at breakneck speeds, we can expect to see the emergence of even more innovative payment methods, which will be safer and more convenient than anything we have right now. While it’s difficult to predict exactly what the future might bring, one thing we can say for sure is that cash will no longer be king. In fact, industry experts predict that cash payments will account for less than 30 per cent of transactions by 2025. So, which payment method will take over the crown then?

A growing number of retailers are now accepting cryptocurrency payments. The luxury fashion brand Ralph Lauren is one of them. The brand has opened a new Web3-based store in Miami where customers can use digital currencies like Bitcoin, Ethereum, and Polygon to pay for their purchases. Another company to incorporate blockchain technology is Starbucks. The popular coffeehouse chain recently launched a new blockchain-based loyalty programme called Starbucks Odyssey. Envisioned as an extension of the company’s existing loyalty programme, Starbucks Rewards, it enables customers to earn collectable, coffee-themed NFTs by completing various interactive activities, such as watching videos, taking quizzes, or going to a Starbucks store to try out new beverages. These NFTs also unlock access to a wide range of online and real-world experiences, such as a virtual class where you learn how to make espresso martinis, special events hosted at Starbucks Reserve Roasteries, or a trip to a Starbucks coffee farm in Costa Rica.

Privacy and ethical issues abound

As innovative payment methods like biometrics become more prevalent in the retail industry, concerns over privacy and ethics are increasingly coming to the forefront. While biometric authentication offers a fast, convenient, and secure payment experience, questions arise about the collection, storage, and use of personal biometric data. For instance, the supermarket chain Southern Co-op is facing legal action from privacy campaigners Big Brother Watch over its use of live facial recognition (LFR) technology in stores across the UK. As shoppers enter the store, their faces are scanned by a single camera. The images are then converted into numerical data for comparison against a watchlist of individuals who are believed to have stolen from the retailer’s stores or acted violently. The privacy group called the retailer’s actions “unlawful, deeply unethical, and chilling” and called for the information commissioner to stop it immediately. Similarly, one New Yorker recently filed a class action lawsuit against Amazon. The company reportedly failed to alert its Amazon Go stores customers that they were being continuously monitored by biometric recognition technology, which it was required to do according to a new law. Numerous industry experts are also questioning the technology’s accuracy. In fact, facial recognition technology has already led to several wrongful arrests and has been repeatedly criticised for its inability to correctly identify people of colour.

In closing

The future of payments is evolving rapidly, and we are entering an era in which technology transforms the way we pay for goods and services. Biometrics and wearables are revolutionising the checkout process, with facial recognition and iris scanning enabling consumers to make purchases without the need for traditional payment methods like cash, cards, or PINs. The use of alternative assets like cryptocurrencies is also growing in popularity, and we can expect to see even more retailers accepting these payment methods in the future. Ethical and privacy issues need to be considered, however, to ensure that customer data is protected and transparency is maintained.