If we look at how a normal bank normally handles this, we see the principle of the general ledger. Transactions - deposits, payments, withdrawals and receipts - are all recorded centrally in a ledger and kept there. The bank thus has an overview of all money flows and guarantees that your balance based on the ledger really belongs to you. This is a safe and orderly thought for yourself and for others.

Trust

But how can you rely on that to happen without such a bank? After all, if no one centrally holds your property (or debt), can you trust that someone else (a peer) will have real money to pay you right away or that someone else will actually deliver something after you pay them?

The answer to this consists of several steps :

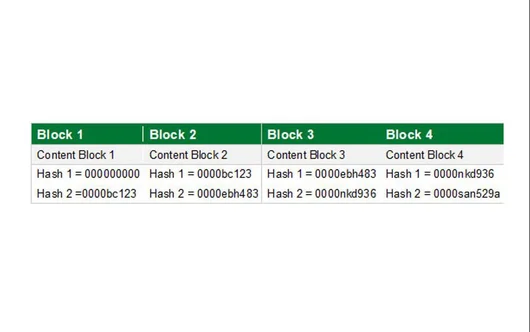

- The creation of a blockchain in which all transactions are recorded in blocks, digitally signed, so that they cannot be changed just like that afterwards .

So, a hash-based ledger that contains the complete history of all transactions, which we know to be correct and with which we can verify whether someone who wants to make a subsequent transaction (still) has the means to do so. - The creation of a large number of copies (nodes in a peer-to-peer network) of such a blockchain (ledger) for an unlimited number of anonymous users (the peers). In it, all the nodes know the same, complete transaction history (size, time, nodes).

So a distributed ledger. - The creation of digital encryption keys (private keys and public keys), used for decentralized approval and handling of transactions (i.e., payments and receipts) between nodes.

Elimination of the need for controlling intermediaries, who centrally manage or control the transaction records: banks, governments, accountants, notaries.